WARSAW

T: +48 22 375 40 40

ul. Cybernetyki 19/B

B2RLAW 2020. All rights reserved.

Cookies Privacy Policy

A fine and an administrative penalty at the same time: does this constitute a double punishment for the same thing?

One of the principles of criminal law is that for one crime, an offender can only be sentenced once, for example, to a fine. However, in practice, it is often the case that in addition to a fine, a convicted person is also subject to another type of financial penalty. What is the reason for this?

An example of this can be the imposition of both a criminal fine and an administrative penalty under the Fiscal Penal Code and other legislation. For explanatory purposes, we refer to the Gambling Act. The Supreme Administrative Court indicated that there are no obstacles for the legislator to simultaneously establish a financial administrative penalty and a criminal fine in criminal and fiscal proceedings based on the same facts for the act of arranging a game without a license on slot machines outside a casino. Such a decision was possible because conducting gambling without a permit or license, or violating this permit or license, is prohibited under both the Fiscal Penal Code and the Gambling Act.

Interestingly, this decision was made regarding a person who did not own the gaming equipment or install it on his premises, but only rented out the part of the premises where the gaming machine was placed. The Supreme Administrative Court decided that the owner of the premises was actively involved in conducting the prohibited activity noting that if it were not for the lessor, it would not have been possible to conduct such activity in this place.

As the jurisprudence indicates, the “double” punishment of the same person for the same act, as in the above example, only seemingly violates the prohibition of double criminality. This is due to the different functions of criminal and administrative responsibility. It is emphasized that the purpose of an administrative penalty is principally to recover undue benefits, while the purpose of penalties imposed on the basis of the Fiscal Penal Code is primarily to pay for breaking the law. According to the Constitutional Court, the concurrent punishment of a fine and an administrative penalty has been found to be consistent with the Constitution.

However, it should be remembered that any imposition of penalties on an entity must meet the requirements of proportionality. The determination of whether a penalty is proportionate depends on the individual circumstances of a case. In cases conducted on the basis of the Fiscal Penal Code and the Gambling Act, the complexity is exacerbated by the need to also apply the provisions of EU law. This is, however, the subject for another article.

How to limit your potential liability to the tax authorities. A closer look at the anti-avoidance clause.

Everyone must comply with their responsibilities and public duties, including the payment of taxes, as specified by Article 84 of the Constitution. Poland has relatively strong measures to enforce compliance with tax obligations, and an example of this is the so-called anti-avoidance clause. This considers whether a legal or factual act was carried out in order to obtain a tax advantage and determines the amount of tax liability in accordance with the real nature of an act and not in accordance with what the taxpayer declared or demonstrated, regardless of other consequences, such as the possibility of initiating penal and fiscal proceedings.

However, the legal possibilities of the State are not unlimited and it is worth noting an existing limitation stemming from the statute, according to which, the anti-avoidance clause does not, in principle, apply to an entity which has obtained a protective tax ruling, to the extent covered by the ruling, until the effective date of the revocation or amendment of a protective ruling. It should be noted that there is a difference between a protective tax ruling and an individual tax interpretation because, in the case of individual interpretations, it is not possible for the authority to conclude that there are no grounds for applying the tax avoidance clause, and, furthermore, no interpretations appear to be issued regarding elements of the facts or future events which are reasonably foreseeable to be the subject of a decision under the anti-avoidance clause. An application for a protective tax ruling may relate not only to a planned action, but also to actions already initiated or carried out.

In order to avoid any negative consequences or potential disputes with the tax administration, any application should be submitted as early as possible. It is important to note that, despite the requirement to describe in detail all the circumstances of the act to be assessed, the interested party does not have to indicate the tax consequences, including financial benefits, resulting from the act covered by the application. The Supreme Administrative Court has also expressed such a position in one of its judgments.

One should be aware that merely submitting an application for a protective tax ruling does not prevent verification activities, tax inspections, tax proceedings or customs tax inspections being carried out. This instrument is not, however, particularly popular: by the end of 2019, only 9 decisions on protective rulings had been issued, three of which were negative, and the small number of entities which have used this instrument is probably due to the amount of the fee for an application for a protective ruling, which is PLN 20,000. Nevertheless, it is worthwhile considering this method of protection in specific cases.

Marcin Malinowski

Advocate

Jakub Przybyliński

Advocate Trainee

Is the completion of a customs and tax inspection the end of challenges for taxpayers, or just the beginning?

It is a truism to say that any inspection of the correctness of a business’s actions is an unusual event from its perspective and raises numerous doubts as to its legitimacy.

The constant changes in the law have also affected this area over the years, as customs and tax inspection was introduced into the legal order in 2016.

The completion of a customs and tax inspection does not always mean the end of proceedings because the consequence of such an inspection may be the initiation of tax proceedings, which, in turn, often end with a decision creating a legal issue for the taxpayer.

As a rule, after a customs and tax inspection is completed, the result is drawn up and delivered to the subject, and if the authorities find no irregularities, the delivery of the result is the end the procedure, after which, the subject is entitled to submit a correction of their previously submitted tax return. Making a correction after 14 days from the delivery of the result does not cause legal effects, so it is assumed to be late.

This, however, is not the end, because, even though the tax return has been corrected, tax proceedings may be initiated against the subject. The inspecting authority may simply disregard the correction and it may also conclude that, due to the submitted correction, there are grounds for determining further tax liability. However, taxpayers often do not want to file corrections because they do not agree with the authority, and filing a correction may oblige them to pay additional tax. Thus, the result of an inspection can lead to the initiation of tax proceedings.

But what if the subject of such an inspection does not agree with it?

Unfortunately, the only possibility is to file a corrected tax return. As the process results from the judgment of the Provincial Administrative Court in Rzeszów of 10 September 2019, the result of the inspection does not shape the rights and obligations of the subject, so it cannot be considered a decision. Consequently, the subject is not entitled to lodge an appeal against an inspection result. A subject is only entitled to lodge an appeal against the decision issued in the tax proceedings which will be initiated if no correction is made.

The above is only an example of the many issues related to customs and tax inspections and the description presented is not exhaustive.

Marcin Malinowski

Advocate

Jakub Przybyliński

Advocate Trainee

European Challenges in Advertising CBD: Poland

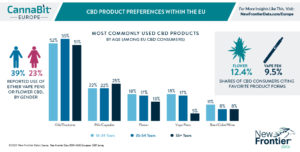

As has been previously detailed in this space, as more Europeans embrace cannabidiol (CBD), significant opportunities are arising for producers and retailers to build continent-wide brands. Doing so effectively will require a nuanced understanding of the differences between the continental market’s eight generally established regional markets, and creating products (and messaging strategies) which are sufficiently well aligned to meet the needs of the fastest-growing consumer groups.

By George Havaris and Malwina Niczke-Chmura, B2R Law (special to New Frontier Data)

CBD products as such feature a high CBD content as opposed to any amount of Δ9-THC content (delta-9-tetrahydrocannabinol and tetrahydrocannabinoleic acid), which cannot exceed 0.20% on a dry-weight basis.

Hemp-derived products for centuries held a significant position in nutrition and traditional medicine. In contemporary times, they for decades lost their popularity due to restrictive drug policy, but for several years now interest in the nutritional, useful and medicinal properties of such products have increased and, consequently, their value in the global cannabis market is growing.

In the food industry, including the dietary supplements market, there is a wide range of CBD products available. In Poland (where B2R Law is based and practices), while there is no legislation that specifically regulates trading or advertising such products, entities operating in the space are not entirely at liberty to operate at will. A general rule of advertising is that it must not mislead the customer or unduly influence his/her decision to buy a good or service. Otherwise, such conduct would be an act of unfair competition which, in some cases, may rise to the level of a criminal offense.

Under European Union (EU) law, labeling, presentation, and advertising cannot attribute characteristics and properties to food that it does not possess. A message that states, suggests, or implies a link between good health and a particular food product (or its ingredients) is called a health claim.

To prevent consumers from being misled, restrictions prohibit the use of health claims about ingredients for which no nutritional/medicinal efficacy has been confirmed (or for which no unequivocal scientific position exists). Pursuant to EU regulations, health claims are forbidden if (a) the European Commission (EC) did not grant permission to use them (in accordance with Regulation 1924/2006), and (b) they do not appear on the list of permitted health claims. The list of permitted statements includes content about the nutrients contained in seeds, hemp oil, and their preparation (Regulation 432/2012); therefore, the provisions allow consumers to be informed about the products’ health benefits.

In the case of CBD, it appears that no applications have yet been made to authorize health claims regarding any benefits of cannabidiol. Subsequently, many CBD products may be advertising illegally.

Legal uncertainty also impacts certain CBD products classified as food, in the context of regulations pertaining to novel food. Products derived from plants or parts of plants of Cannabis sativa L. (such as seeds, seed oil, hemp seed flour, defatted hemp seeds, etc., have a documented history of consumption in the EU before 15 May 1997. It likewise follows that either the hemp-fiber component or an intermediate product obtained from the plant (which naturally contains inherent levels of CBD) are not subject to restrictions on novel foods.

However, CBD in any other form (i.e., [1] CBD obtained from higher hemp concentrations than naturally occurring in the plant, [2] CBD from plants other than hemp, or [3] synthetic CBD) qualify as novel foods and thus must be authorized by the EC to be food ingredients. Placing such products on the market as foodstuffs first requires that the procedures set out in Regulation (EU) 2015/2283 on novel foods are followed. If the process is positive, the EC authorizes the availability of novel foods on the EU market (with the EU list duly updated).

Producers of CBD products are advised to exercise caution in preparing their products for market. Beyond the commonly significant expense of an advertising budget, unexpected legal issues may arise. Additionally, producers ought to be mindful of how even a properly structured advertising message can be blocked, as often happens across the most popular advertising media, including Facebook and Google ads.

For a more comprehensive review of regional EU consumer tastes, download New Frontier Data’s EU CBD Consumer Report: 2019 Overview; download the full report here to gain deeper insight into Europe’s expansively emerging consumer markets.

Source: newfrontierdata.com

Can a penalty fee for the early termination of a lease agreement be classified as a tax-deductible cost?

A Company, which was leasing service premises under a lease agreement concluded for a definite period, decided to terminate the lease early because it was unprofitable. This could have happened to anyone, especially during the coronavirus epidemic.

When the parties terminated the lease agreement, they agreed that the company would pay a lump-sum penalty fee to the lessor.

On 29 December 2015, the Director of the Tax Chamber in Warsaw, acting on behalf of the Minister of Finance, issued an individual interpretation for the company, No. IPPB3/4510-833/15-2/DP, in which he considered the position of the company regarding the possibility of including the fee paid for the early termination of the lease agreement as a tax deductible cost.

The Company filed a complaint against this interpretation of the tax law with the Provincial Administrative Court in Warsaw (WSA), which, in its judgment, annulled the contested individual interpretation and ruled that Article 15 (1) of the CIT Act obliges it to take into account the whole context of the taxpayer’s economic activity, as it is only from this perspective that it can be assessed whether the expenditure was incurred for the described purposes or not.

It is important to note that the intention of the taxpayer to reduce losses and not only to increase the profits generated by a certain part of company’s activity justifies the view that the expense is deductible.

Losses reduce income and therefore, reducing or eliminating a loss leads to increased income. Incidentally, this view is apt and can be used in a number of issues in disputes with the tax authorities.

The Head of the National Revenue Administration submitted a cassation appeal against the verdict of the Provincial Administrative Court in Warsaw, which was dismissed by the Supreme Administrative Court.

The Supreme Administrative Court shared the position of the Provincial Administrative Court in Warsaw, stating that, if the termination of a lease agreement and the payment of a fee on that account creates a more favourable situation for the taxpayer resulting in an increase in income, then such action should be considered economically justified and the expense incurred for the additional fee is related to maintaining or securing the source of income.

The Director of the National Tax Information Office shared the taxpayer’s argument that the company, by paying the lessor a fee for the early termination of the lease agreement, sought to preserve and secure its sources of income, and the main purpose of the transaction was to improve its financial standing as continuing to lease the service premises under the existing agreement proved to be unprofitable.

To sum up, a fee paid for the early termination of a lease agreement may be classified as a tax deductible cost if the circumstances of the case and the taxpayer’s motivation indicate that the purpose of the action taken was to secure and preserve sources of income pursuant to Article 15 (1) of the CIT Act.

It is important to properly document these circumstances and to implement certain ways of demonstrating such circumstances.

Marcin Malinowski

Advocate

Kinga Karaszewska

Advocate trainee

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.

Close