WARSAW

T: +48 22 375 40 40

ul. Cybernetyki 19/B

B2RLAW 2020. All rights reserved.

Cookies Privacy Policy

B2RLaw: Celebrating Pride Month 2025

Celebrating Pride Month 2025: Embracing Diversity and Inclusion in Poland!

As June unfolds, we at B2RLaw proudly join the global celebration of Pride Month – a time dedicated to honouring the LGBTQ+ community and reaffirming our commitment to equality, inclusion, and human dignity. We are dedicated to fostering an environment where everyone feels valued and respected. We believe that diversity enriches our perspectives and drives innovation. This Pride Month, we reaffirm our commitment to supporting the LGBTQ+ community and promoting inclusivity within our firm and the broader legal profession.

Let’s celebrate love, authenticity, and the courage to be oneself – not just in June, but every day!

Progress in Poland

Recent surveys indicate a positive shift in public opinion:

+ An Ipsos poll from June 2024 revealed that 67% of Poles support the right of same-sex couples to marry or legally register their relationship.

+ A United Surveys poll in April 2024 showed that 50% support same-sex marriage, and 66% support same-sex civil partnerships.

These figures reflect a growing acceptance and recognition of LGBTQ+ rights within our society.

Economic Implications of Inclusion

Inclusion is not only a moral imperative but also an economic one. A 2025 report by Open for Business highlights that discrimination against LGBTQ+ individuals costs Poland up to 20.4 billion PLN annually, due to factors like brain drain and health-related impacts. Conversely, companies that embrace inclusive policies tend to outperform others financially, enhancing competitiveness on both regional and global levels.

Promotion of Jakub Przybyliński to Senior Associate

It’s high time to announce the well-deserved promotion of Jakub Przybyliński to Senior Associate!

Kuba advanced due to his diligence, precision and analytical skills. This young super lawyer is a TOP TIER 1 member of the White-Collar Crime Team in Poland (Legal 500)! He’s exceptionally talented and ambitious professional with a passion for law, who is quickly earning a reputation as one of the best in their field.

He’s the go-to legal mind when things get tricky, think courtroom chess, but with higher stakes. From fraud and financial mischief to tangled corporate dramas, he’s been in the thick of it all. Whether it’s helping the wrongfully accused or standing up for those who’ve been wronged, he’s done it with sharp thinking and cool confidence.

Known for connecting the dots faster than a detective in a thriller, he crafts solid defense strategies with a touch of brilliance. Always professional, always discreet – he keeps things ethical, classy, and under control.

Kuba, a big congratulations on a well-deserved promotion!

Happy Easter from B2RLaw!

As Easter approaches, we wish you:

+ a rest without litigation deadlines,

+ maybe… a small settlement with calories,

+ lots of balance and plenty of peace!

Pre-Moot session at B2RLaw’s Warsaw office!

Practice makes perfect! University of Warsaw Willem C. Vis Moot Team in a clash with Vis Moot Team Vilnius during a Pre-Moot session at B2RLaw’s Warsaw office.

Arbitrators of the meeting:

B2RLaw: Bartłomiej Jankowski (Advocate, Managing Partner, Head of Dispute Resolution), Magdalena Kalińska (Advocate, Counsel, Head of Banking)

TGS Baltic: Gaile Juozapaityte LL.M. (Associate Partner, Attorney at Law, Head of Arbitration)

We are keeping our fingers crossed for both teams in Vienna

You have the knowledge and the power!

B2RLaw at Vestas’ foundation stone ceremony

Andrzej Zając – Partner and Head of Energy and Property practice at B2RLaw was honored to represent B2RLaw at Vestas foundation stone ceremony for a new Vestas’ factory in Szczecin. The ceremony was witnessed by His Majesty Frederick X, King of Denmark, representatives of the governments of the Kingdom of Denmark and the Republic of Poland, representatives of local administration, customers and business partners.

The foundation stone ceremony was significant event for entire energy sector. This investment is undoubtedly a symbolic cornerstone for the development of Poland as an offshore hub and highlights the importance and potential of the Polish offshore industry.

We would like to thank Vestas team for trusting us with advising on this crucial and challenging project. We are proud to have been supporting Vestas in this extraordinary project and to contribute to such an important and long-awaited energy transition milestone. We cannot wait for the day when the first components of offshore wind turbines will depart from the Szczecin’s factory to the open sea!

B2RLaw advises Bentley Systems’ Cohesive Group on its acquisition of Vetasi

B2RLaw has advised Bentley Systems, Incorporated, the infrastructure engineering software company, and its Cohesive Group digital integrator business, on the Polish aspects of its acquisition of Vetasi, a leading international consultancy specializing in enterprise asset management (EAM) solutions.

Bentley Systems, Incorporated is an American-based software development company that develops, manufactures, licenses, sells and supports computer software and services for the design, construction, and operation of infrastructure. The company’s software serves the building, plant, civil, and geospatial markets in the areas of architecture, engineering, construction and operations.

Cohesive was founded by Bentley in 2020 as a digital engineering systems integrator to help infrastructure owner-operators deliver transformational and sustainable outcomes. Cohesive has achieved consistent significant growth and continues to win substantial new projects, notably in the utilities, transport, and energy sectors.

Vetasi brings to Cohesive the largest IBM Maximo consultancy team across Europe, Africa, and ASEAN countries, with headquarters in the United Kingdom and operations based in Poland, Indonesia, South Africa, Spain, Ukraine, and Australia.

B2RLaw’s team was led by Piotr Szelenbaum (Attorney-at-law, Partner) and included Paulina Wyrostek (Attorney-at-law, Counsel), Piotr Leonarski (Advocate, Tax Advisor, Counsel), Joanna Markowicz – Maciocha (Attorney-at-law, Associate).

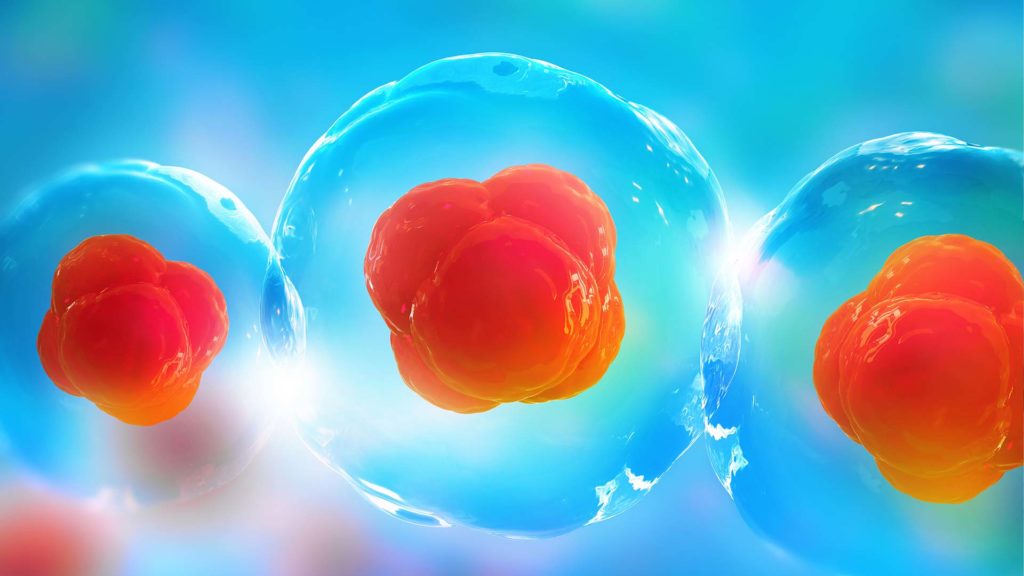

B2RLaw advises Moffitt Cancer Center and OncoBay Clinical in a PLN 150 million investment in OncoBay by Clinscience

B2RLaw has advised Moffitt Cancer Center and OncoBay Clinical, one of its for-profit subsidiaries, in an investment in OncoBay by Clinscience, a global clinical research organization based in Warsaw, Poland. The investment will give Clinscience’s parent company NEUCA Group a majority equity stake in OncoBay. Total consideration was USD 33.5 million (approx. PLN 150 million).

OncoBay is a boutique clinical research organization specializing in immuno-oncology and cell therapy, offering full-service custom curated CRO solutions for global pharmaceutical and biotech companies. Moffitt Cancer Center & Research Institute is a nonprofit cancer treatment and research center located in Tampa, Florida. Established in 1981 by the Florida Legislature, the hospital opened in October 1986 on the University of South Florida’s campus.

NEUCA Group is the market leader in the wholesale distribution of pharmaceutical products industry in Poland.

The companies will work together to advance immune-oncology research for a global portfolio of clients.

B2RLaw’s team advised on Polish aspects of the transaction, and was led by Partner Agnieszka Hajos-Iwanska and included Counsels Luiza Wyrębkowska, Piotr Leonarski (Tax); and Junior Associate Krzysztof Judasz.

B2RLaw advises Polish unicorn DocPlanner on its acquisition of MyDr

B2RLaw has advised Polish unicorn DocPlanner on its acquisition of MyDr – DocPlanner’s first acquisition on the Polish market. Docplanner (operating in Poland under the ZnanyLekarz brand), the operator of an online SaaS platform for arranging medical appointments, has acquired MyDr which provides technological solutions to the medical sector, through its MyDr EDM and Dr100 software.

DocPlanner creates digital apps and software solutions for doctors, clinics, hospitals and patients to enable the healthcare system and patient journey to integrate seamlessly. The platform provides free doctor reviews and instant online appointment booking for patients through its online marketplaces. DocPlanner is used by approximately 85 million patients per month and more than 190,000 doctors globally in 13 countries. The company was founded in 2012 in Poland and now boasts a team of more than 2,600 based across offices in Warsaw, Barcelona, Istanbul, Rome, Mexico City, Curitiba and Bologna. It is backed by leading venture capital funds including Point Nine Capital, Goldman Sachs Asset Management and One Peak Partners, raising a total of approximately EUR 300 million to date.

DocPlanner has made nine acquisitions to date as part of its global expansion strategy, including TuoTempo in Italy, Doctoralia in Spain, and Eniyihekim (now Doktortakvimi) in Turkey, as well as German counterpart Jameda from Hubert Burda Media last year.

MyDr works with 47,000 doctors, and almost 2 million visits are arranged monthly via the company’s software. The company offers several services, including MyDr EDM for managing a medical practice; Dr100 for running dental offices and clinics; and the drNews information system for medical facilities.

B2RLaw advised DocPlanner (ZnanyLekarz) on all aspects of the transaction.

B2RLaw’s team was led by Senior Partner Rafał Stroiński and Partner Aleksandra Polak, and included Partner Marcin Huczkowski; Counsels Malwina Niczke–Chmura and Paulina Wyrostek; Senior Associates Krystyna Jakubowska and Teresa Pilecka–Juda; and Junior Associate Danyila Zubach.

JP Weber acted as Financial and Tax Advisor to DocPlanner on the transaction.

Rafał Stroiński advises, “DocPlanner was founded on the mission of making the healthcare experience more human. The company is considered to be the first Polish unicorn, and has been growing from strength-to-strength globally. With DocPlanner’s exponential international growth, we couldn’t be happier to support DocPlanner on this transaction – its first acquisition on the Polish market, which represents a sort of ‘return home’, and significantly increases DocPlanner’s Polish market share”.

Aleksandra Polak adds, “We would like to thank all those that worked on this transaction, particularly the DocPlanner/ZnanyLekarz team of Mariusz Gralewski, Peter Biało, Piotr Radecki, Zeno Capucci and Łukasz Łyczkowski”.

B2RLaw advises Auxilius Pharma on capital raise to fuel groundbreaking growth to the US market

B2RLaw advised Auxilius Pharma Sp. z o.o. and its founders on a venture capital transaction related to the investment of Cofounder Zone Corporate Angel Fund ASI, AUGEBIT Closed Investment Fund, and several business angels and current partners at Auxilius.

With the new funds, the Company will be able to further develop its flagship project involving introduction of a Value Added Medication cardiological drug to the US market, as well as other drug development projects.

Auxilius Pharma was founded by Jędrzej Litwiniuk and Uwe Tigör in 2019 and is a fast-growing pharmaceutical early stage company with a focus on further developing and optimizing medications well established in some markets but not in others. The Company is currently focused on the development of cardiovascular medicine which is available in the EU but not in the US. Auxilius Pharma has reformulated the drug into a once-daily product in an effort to improve convenience and compliance of patients. Earlier this year, the Company get the nod of the American Food and Drug Administration (FDA) for the clinical development plan of its cardiovascular drug. The Agency agreed to use an expedite, 505(b)2 regulatory pathway for the product, which will allow a speedy and cost-effective regulatory pathway.

B2R’s team was led by Krystyna Jakubowska (Advocate, Senior Associate), who was supported by Teresa Pilecka-Juda (Attorney-at-law, Senior Associate) and Magdalena Zawiślak (Junior Associate). Rafal Stroiński (Advocate, Senior Partner) oversaw B2R’s team. SSW Pragmatic Solutions advised Cofounder Zone, who was represented by Tomasz Goliński and Michał Sioda.

Krysia Jakubowska advises, “we are extremely pleased to have assisted Auxilius Pharma on this exciting transaction. With Poland being one of global leaders in cardiac treatment, it is pleasing to advise on a transaction which provides Auxilius and its founders with the funds which will allow it to continue developing its cardiovascular drug with the view of bringing this effective medication to US patients and clinicians. ”

B2RLaw advises Westcoast on merger to create EUR 5.5 billion ICT distributor

B2RLaw has advised the UK’s largest privately owned information and communications technology company Westcoast on Polish aspects of its merger with German company KOMSA.

The distribution alliance gives Westcoast access to more of continental Europe, with KOMSA able to expand into the UK, Ireland and France.

The merger of the two distributors will create the largest privately held European alliance in the ICT industry, with a workforce of more than 2,200 employees and more than 400 technology partners with 30,000 retail partners. The companies will generate combined sales of more than EUR 5.5 billion.

Established in 1984, Westcoast Group distributes leading IT brands such as HP, HPE, Microsoft, Lenovo, Apple, Samsung and many others to a broad range of resellers, retailers and office product dealers in the UK and wider Europe. The Company is consistently ranked in the Sunday Times Top Track of the 100 Largest Privately-owned UK Companies.

KOMSA AG was founded in Hartmannsdorf in 1992. It is a leading European distributor and service provider for modern communications technology. KOMSA entered the Polish market in 1999 and is one of the leading ICT distributors in Poland. KOMSA Poland remains the Company’s only subsidiary outside of Germany.

The merger is still subject to the approval by the competent authorities, but the first closing is anticipated for January 2023.

B2RLaw’s team was led by Aleksandra Polak (Advocate, Partner) and included Paulina Wyrostek (Attorney-at-law, Counsel), Joanna Markowicz-Maciocha (Attorney-at-law, Associate) and Danyila Zubach (Junior Asoociate).

B2RLaw worked alongside UK law firm BDB Pitmans LLP.

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.

Close